Gold Prices What Irish Investors Need to Know

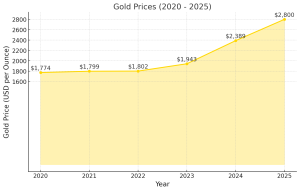

Gold has always been a symbol of wealth and security, but 2025 has brought a surge in gold prices that has caught the attention of investors worldwide. For Irish investors, understanding what is driving this gold price rally is critical for making informed financial decisions.

The Key Drivers Behind Gold Prices in 2025

Several powerful forces are currently fueling the rise of gold prices in 2025:

- Global Inflation Pressures

Persistently high inflation rates across major economies, including the Eurozone, have driven investors towards gold as a traditional hedge. The ongoing cost-of-living crisis in Ireland has made this trend particularly relevant for local investors seeking stability.

- Central Bank Gold Buying

In 2025, central banks globally have ramped up their gold reserves, pushing demand to record levels. Countries like China, India, and Russia continue to increase their gold holdings, reducing reliance on the US dollar and creating upward pressure on gold prices.

- Geopolitical Tensions

Continued geopolitical instability, particularly in Eastern Europe and the Middle East, has led investors to seek safe-haven assets like gold. These tensions have made gold more attractive as a store of value amid uncertainty.

- Weakening of Major Currencies

The US dollar and Euro have both shown signs of weakness in 2025, largely due to mounting debt levels and monetary easing policies. A weaker dollar traditionally correlates with stronger gold prices.

- Increased Retail Investment

More young investors in Ireland are turning to gold as part of diversified portfolios, spurred by easy access to online gold dealers and investment platforms.

Why This Matters for Irish Investors

For Irish investors, the soaring gold prices in 2025 present both opportunities and risks. While gold can act as a powerful hedge against inflation and economic downturns, timing and entry points are crucial.

Benefits of Investing in Gold in 2025

- Inflation Protection: Gold retains its value over time, providing a safety net against the erosion of purchasing power.

- Portfolio Diversification: Adding gold can reduce portfolio volatility and protect against market shocks.

- Safe Haven Asset: Amid global conflicts and financial instability, gold offers stability.

Potential Risks

- Price Volatility: Gold prices, though trending upward, can experience sharp short-term corrections.

- Storage and Security Costs: Physical gold requires safe storage, which can be expensive if using secure vaults in Ireland.

- No Yield: Unlike stocks or bonds, gold does not produce income.

How to Start Investing in Gold in Ireland

- Physical Gold: Purchase gold bars or coins from reputable dealers. Ensure proper certification and consider storage options.

- Gold ETFs: Exchange-Traded Funds offer exposure to gold prices without the need to store physical metal.

- Gold Mining Stocks: Investing in gold producers can offer leverage to gold price movements.

- Online Gold Platforms: Irish investors now have access to reliable online gold marketplaces that offer fractional gold ownership.

Expert Tip

Before investing, always research dealers, compare prices, and consider the costs associated with each investment method. It’s also wise to monitor the Irish and global economic outlook regularly.

Related reading on our site

External good reading Suggestions

Conclusion:

Gold prices in 2025 are soaring for clear, identifiable reasons that Irish investors cannot afford to ignore. Whether as a hedge against inflation, a diversification tool, or a safe-haven asset, gold remains a critical consideration in the current economic climate. Staying informed and making strategic choices will be key to navigating this golden opportunity.

If your new to Gold and the precious metals market, please check out this page where you can learn how to purchase gold